net investment income tax 2021 proposal

Medical Tax Credits adjusted by less than inflation to help fund the rollout of the National Health Insurance. In 2031 and beyond the cap on SALT deductions would revert to 10000 unless further Congressional action occurs.

Ulip Is Taxable Tax Free Investments Start Up Business Income Tax

Tax-free threshold increases from R79 000 to R83 100.

. CCI Jobs FindPost your vacancy. An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns. Your employer may soon ask you to submit the investment proofs for the Financial Year 2020-21.

Though barely 100 years old. Budget 2021 contains several major income tax changes affecting Canadian businesses and individual taxpayers. Currently carried interests are taxed as short-term capital gains unless the gains were on property held for at least three years.

In particular Budget 2021 proposes to introduce significant new interest deductibility and anti-hybrid structure rules a new digital services tax new CRA auditing powers and a new reporting regime and announces an upcoming consultation on. Personal income tax brackets adjusted above inflation after two years of no change. Using the simpler NOPAT formula where NOPAT Operating income x 1 tax rate NOPAT will be 200000 X 1 04 which is 120000.

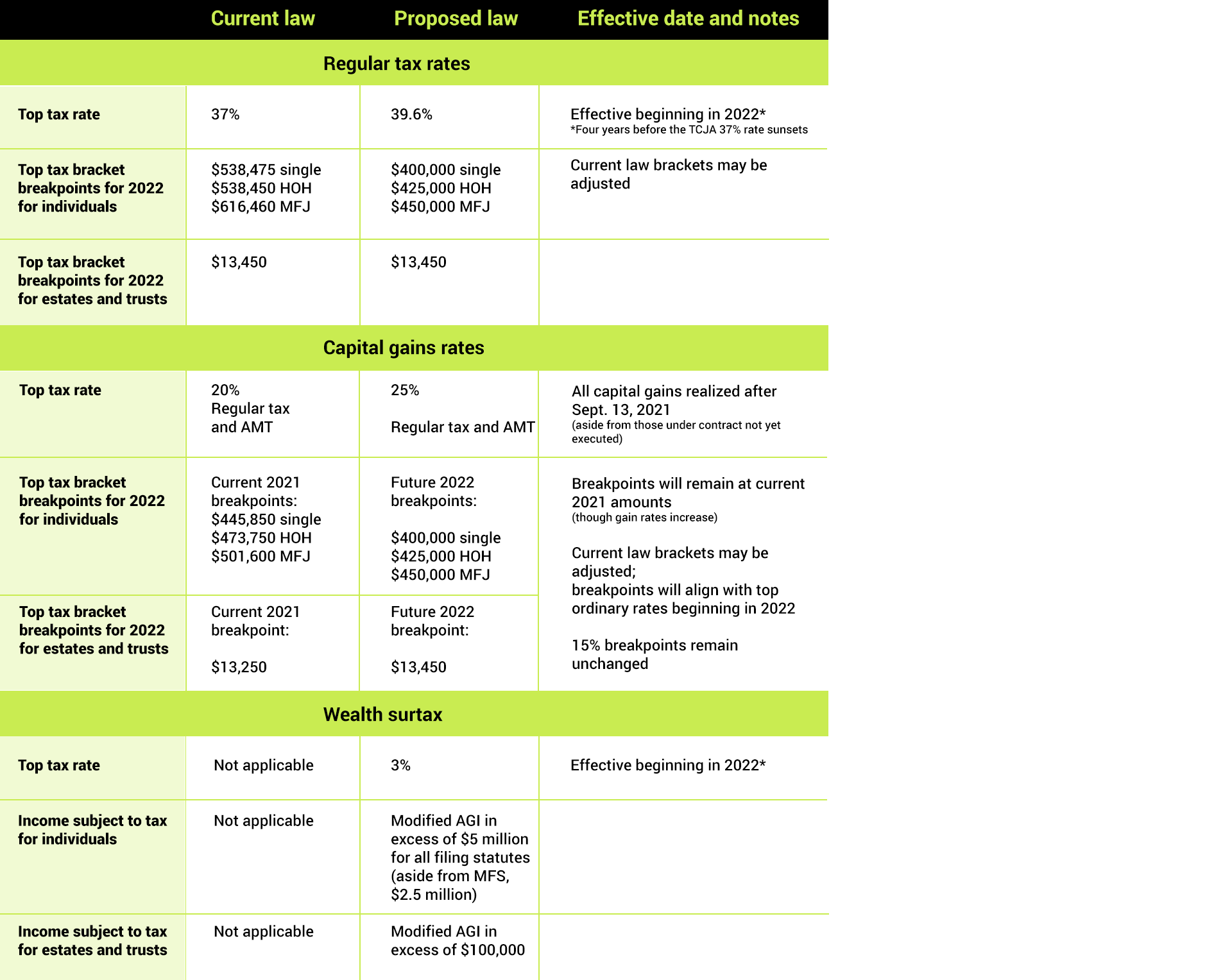

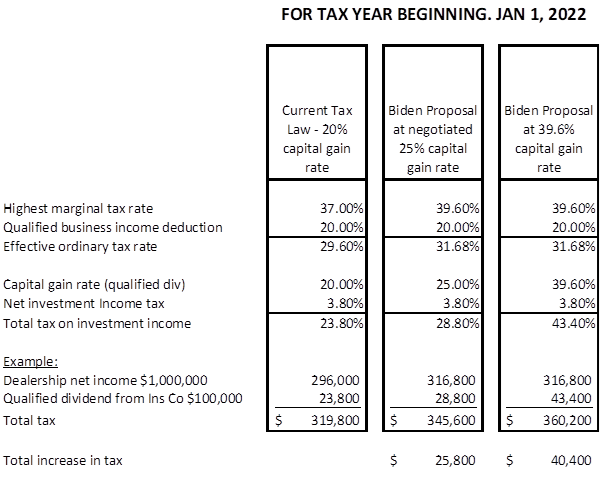

In practice many investment funds including AIF should however not be impacted by these rules notably under the Collective Investment. The use of the second more complex NOPAT formula where NOPAT Net income non-operating income loss non-operating income gain interest expense tax expense x 1 tax. Tax long-term capital gains as ordinary income for taxpayers with adjusted gross income above 1 million resulting in a top marginal rate of 434 percent when including the new top marginal rate of 396 percent and the 38 percent Net Investment Income Tax NIIT.

Tax changes that could affect investments. The new rule would apply for the 2021 tax year and each year thereafter through 2030. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment.

The BBBA would extend the holding period to. Imposes a progressive income tax where rates increase with income. Hence NOPAT is 120000.

CCI Online Learning Learn CA CS CMA. Instead of being available for all of 2021 it would no longer be available for the fourth quarter except for recovery start-up businesses. Budget 2021 proposes to amend the Income Tax Regulations to allow issuers of T4A Statement of Pension Retirement Annuity and Other Income and T5 Statement of Investment Income information returns to provide them electronically without having to also issue a paper copy and without the taxpayer having to authorize the issuer to do so.

This is a provisional statement that has. While such entities are in principle not subject to any income tax they will become subject to Luxembourg corporate income tax on a portion of their net income provided the conditions of reverse hybrid rules are met. Increase in the cap on the exemption from 1 March 2020 to R125 million per year.

California utilities have proposed Net Energy Metering NEM 30 which if approved would significantly alter the utility bill structure rates and charges for homeowners going solar. Discussing Income Tax Deductions us 80C 80CCC 80CCD1 80CCD1b 80D 80E 80EE 80EEB 80G 80GG 80GGC 80TTA 80TTB 24b and 87A that are applicable for FY 2020-21. The Financial Year end is round the corner.

Previous proposals included an increase in the top applicable tax on long-term capital gains on the sale of assets held more. If you are an employee of a company at the beginning of every financial year or while joining the company you have to submit Income Tax Declaration to your employer. Well break down how Net Metering works the proposed changes the utilities reasoning and next steps for NEM 30.

Net Investment Income Tax NIIT.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

House Introduces Major Tax Proposals Baker Tilly

House Democrats Tax On Corporate Income Third Highest In Oecd

The Future Of Captive Reinsurance Companies Under The Biden Tax Plan Withum

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

What Is The The Net Investment Income Tax Niit Forbes Advisor

Tax Facts On Individuals 127th Edition Ebook In 2021 Business Ebook Health Insurance Humor Small Business Accounting

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay