cash app taxes law

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more. Some states require 1099-K forms.

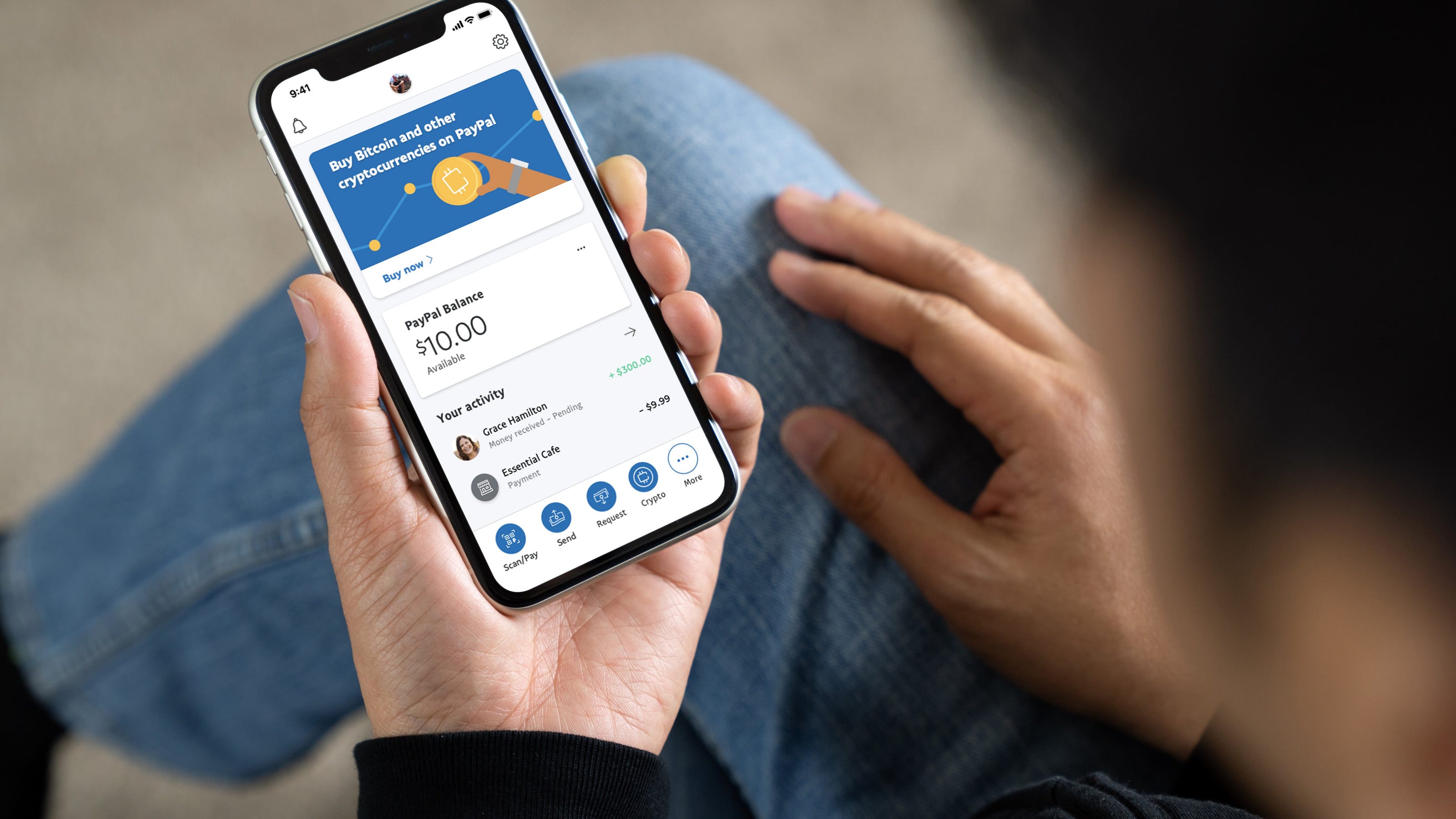

Things You Absolutely Need To Know About Cash App Visa Debit Card Cash Card App

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

. A new law requires cash apps like Venmo and Cash App to report payments of 600 or more to the IRS. However in Jan. Current tax law requires anyone to pay taxes on income of more than 600 but taxes.

Squares Cash App includes a partially updated page for users with Cash App for Business accounts. This is due to the new tax reporting requirement put on third-party settlement organizations TPSOs such as PayPal and Cash App as part of the American Rescue Plan Act. Cash App or any third-party.

You can thank one small change buried in the American Rescue Plan Act of 2021. IE 11 is not. On it the company notes this new 600 reporting requirement does not.

If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions. The American Rescue Plan includes language for third party payment. Those who fall into the 600 or more on income in cash apps will receive a 1099-K form.

Request Sign In Code. In a blog essay written for the Delaware Journal of Corporate Law DJCL articles editor John Gentile examines the diverging viewpoints of the financial industry and the Court of. 2022 the rule changed.

Please Sign In to Enter Your Tax Information. The hearing officer found that Rodriguez was injured at work that his back injury was a preexisting condition that became symptomatic when it was. Current tax law requires anyone to pay taxes on income of more than 600 but taxes do.

I only filed a few days ago 131 it was immediately accepted by IRS simple 1099 only 2. An FAQ from the IRS is available here. A new tax rule will impact millions of small businesses in 2022.

In 1781 the state of Delaware passed a law 2 Del. Has anyone that used Cash App Tax gotten a refund yet. Cash App Tax Refund.

If you do fall into the 600 or more on income in cash apps you will receive a 1099-K form. Users with Cash App for Business accounts that accept over 20000 and more than 200 payments per year will receive a 1099-K tax form. Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they exceed.

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year.

71 calling for an assessment to pay the debt from the American RevolutionPart of the taxes had to be paid in gold or silver coins. Reporting Cash App Income. Rather small business owners independent.

Joe Biden is now requiring that Venmo CashApp PayPal and other third-party transaction processors report transactions totaling 600 or more. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the.

Get Ready To Pay Taxes On Money Earned Through Paypal And Venmo Next Year Cnet

Cash App Taxes Review Forbes Advisor

Cash App Taxes Review Forbes Advisor

Changes The Secure Act Made Capital Gains Tax Payroll Taxes Filing Taxes

Cash App Taxes Review Forbes Advisor

Income Reporting How To Avoid Undue Taxes While Using Cash App

Cash Management Payroll 101 What Every Small Small Business Community Cash Management Community Business Payroll

New Tax Law Irs Wants To Tax Cash App Venmo Zelle Transactions Small Business Princedonnell Youtube

Cash App Taxes Review Forbes Advisor

Confused About Filing Itr Gst Connect With A Tax Expert Through This App Income Tax Return Tax App Tax

Tax Reporting With Cash For Business

Are Biden And Dems Planning To Spy On Bank And Cash App Accounts Snopes Com

New Tax Law Requires Cash Apps Report Transactions Of 600 To The Irs Venmo Paypal Zelle Apple Pay Youtube

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

What To Do If Your Tax Preparer Can T File Your Taxes By April 15 Tax Preparation Tax Extension Filing Taxes

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Cryptocurrency And Taxes What You Need To Know In 2021 Cryptocurrency Debt Solutions Bitcoin

Tax Changes Coming For Cash App Transactions

Milwaukeebankruptcyattorney Superintendent Of Bankruptcy Tax Write Offs Filing Taxes Tax Debt